Background

A leading Australian customer-owned bank identified an opportunity to proactively engage customers nearing the end of their fixed-rate home loan terms. The goal was to create a simple, effective digital experience that would encourage customer retention and reduce churn to alternate mortgage providers.

Fujifilm DMS partnered with the bank to design and deliver a digital retention solution that significantly improved engagement and operational efficiency.

Discovery & solution design

The engagement began with collaborative workshops to understand the bank’s end-to-end processes, customer journeys, business rules and regulatory obligations.

Key project objectives included:

- Making the customer experience simple and compelling to minimise reliance on branches and contact centres

- Eliminating paper-based communications to reduce turnaround times and costs

- Providing personalised interest rate options across variable and fixed terms (1, 2, 3 and 5-year loans)

- Supporting multiple account holders and associated approval workflows

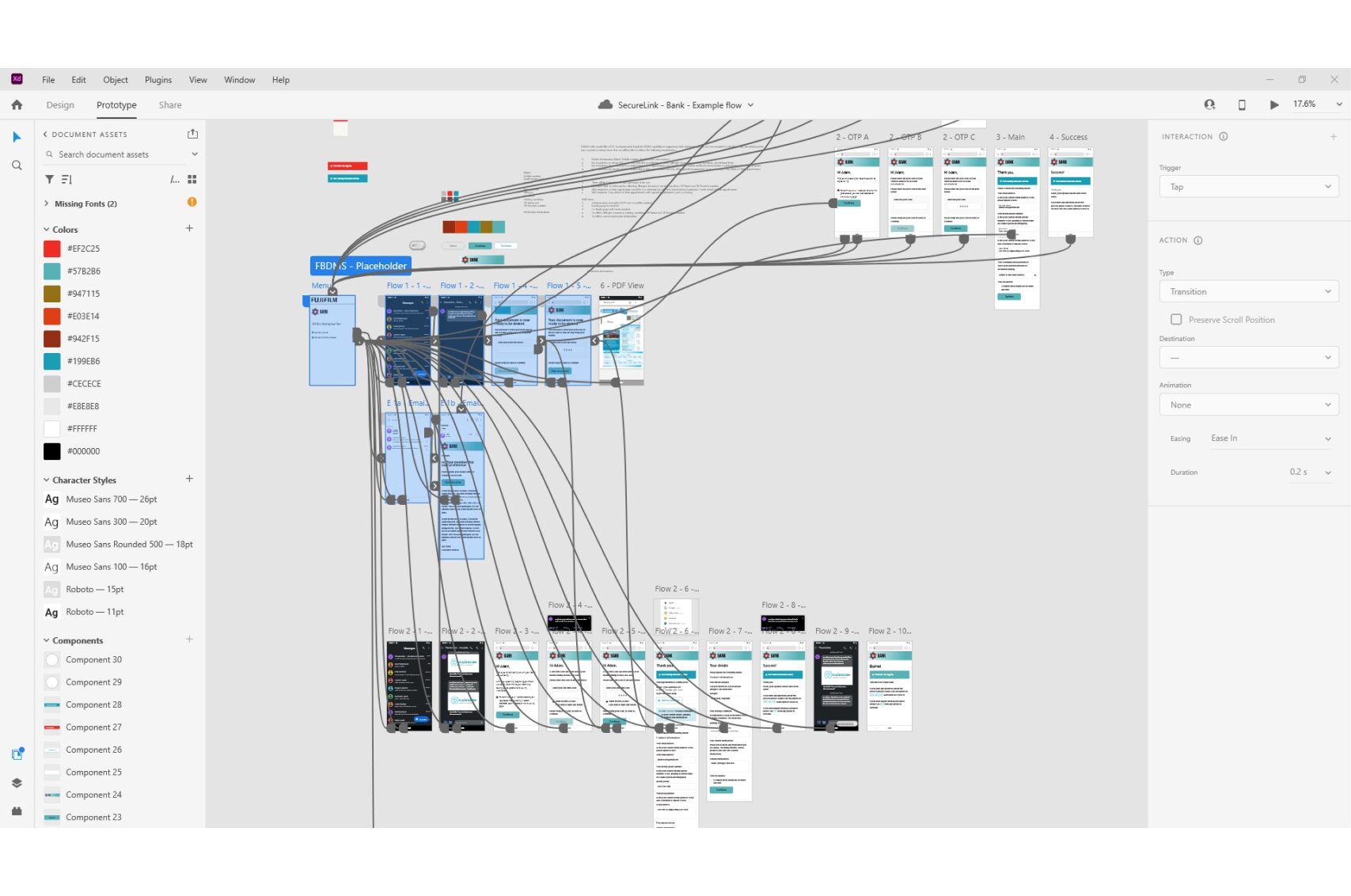

The Fujifilm DMS team worked closely with the bank’s project team to address all business requirements and complex workflows. User Experience (UX) specialists developed interactive prototypes, enabling stakeholders to visualise customer journeys and refine key components iteratively. This collaborative and agile approach ensured the solution was user-friendly, efficient and accelerated delivery timelines.

Implementation highlights

The final solution delivered a fully digital, end-to-end customer engagement experience, including:

- A branded email sent eight weeks before fixed-rate expiry, clearly outlining the default rollover option and new fixed-rate choices

- A secure, tokenised link directing customers to an interactive branded landing page

- Identity verification through SMS One-Time Passcode (OTP)

- Separate workflows for primary and secondary account holders

- Automated triggering of secondary workflows following primary account holder actions

- Real-time integration with the bank’s Open Banking APIs, dynamically generating personalised rate offers by applying margin discounts to base rates

- Comprehensive tracking of customer interactions, campaign analytics, and reporting

- Secure transmission of all collected master data back to the bank

- Automated and ad hoc expiration of offers based on acceptance or expiry criteria

Results & outcomes

The implementation delivered outstanding results:

- Less than 2% of customers required alternate engagement through branches or the contact centre

- Less than 1% of customers needed reminder communications

- Over 20% of customers directly accepted loan offers via the platform, choosing either a variable-rate or new fixed-rate mortgage

- Zero customer complaints were received during the campaign

This proactive retention solution created an efficient, fully digital experience that helped retain customers, streamline operations, and reduce engagement costs.